Superannuation Guarantee Charge – What You Need to Know

The superannuation guarantee charge (SGC) rate will be increasing to 11% from 1 July 2023. It will then continue to increase by 0.5% until July 2025 when it reaches 12%.

Practical steps to consider for your business in the lead up to this change are:

1. Check whether your employee contracts are inclusive of superannuation or whether super is paid on top.

2. Where your employee contracts are inclusive of super, the extra 0.5% will be paid into superannuation which will decrease the net take home pay to the employee by the same amount. This will not impact the overall payroll payment payable by your company for the year.

3. Where your employee contracts are exclusive of super, your employees will receive 0.5% more superannuation in their fund and their take home pay will remain unchanged. This will increase the company’s payroll liabilities to fund the additional 0.5% super increase.

4. You need to discuss the super rate increase with your employees now so they understand the impact the increase will have on their personal payroll situation from 1 July 2023 .

5. Employers should be aware that late payment of super can incur large penalties – so plan now for the cashflow impact of higher payroll expenses from July.

6. To obtain a tax deduction for FY2023 funds must have reached superannuation funds by the 30 June 2023. Xero software requires superannuation payments made via their clearing house to be made by 2:00pm on 14 June to enable Xero to guarantee the funds will be received by the deadline date.

If you are unsure how this change will affect your payroll costs and employee contractual arrangements, please contact us today so we can assist you to plan and prepare for these increases.

Our CEO’s Top 5 Tips to Get EOFY Ready

The end of the financial year is just around the corner and in our latest video CEO Trish Catlin shares her top five essential tips to make sure your business is EOFY ready. From analysing business performance to meeting with your tax agent, she offers comprehensive guidance to maximise your financial success.

Watch the video here to optimise your strategies for the upcoming year.

If you need assistance getting EOFY ready, get in contact with our team on 1300 472 412.

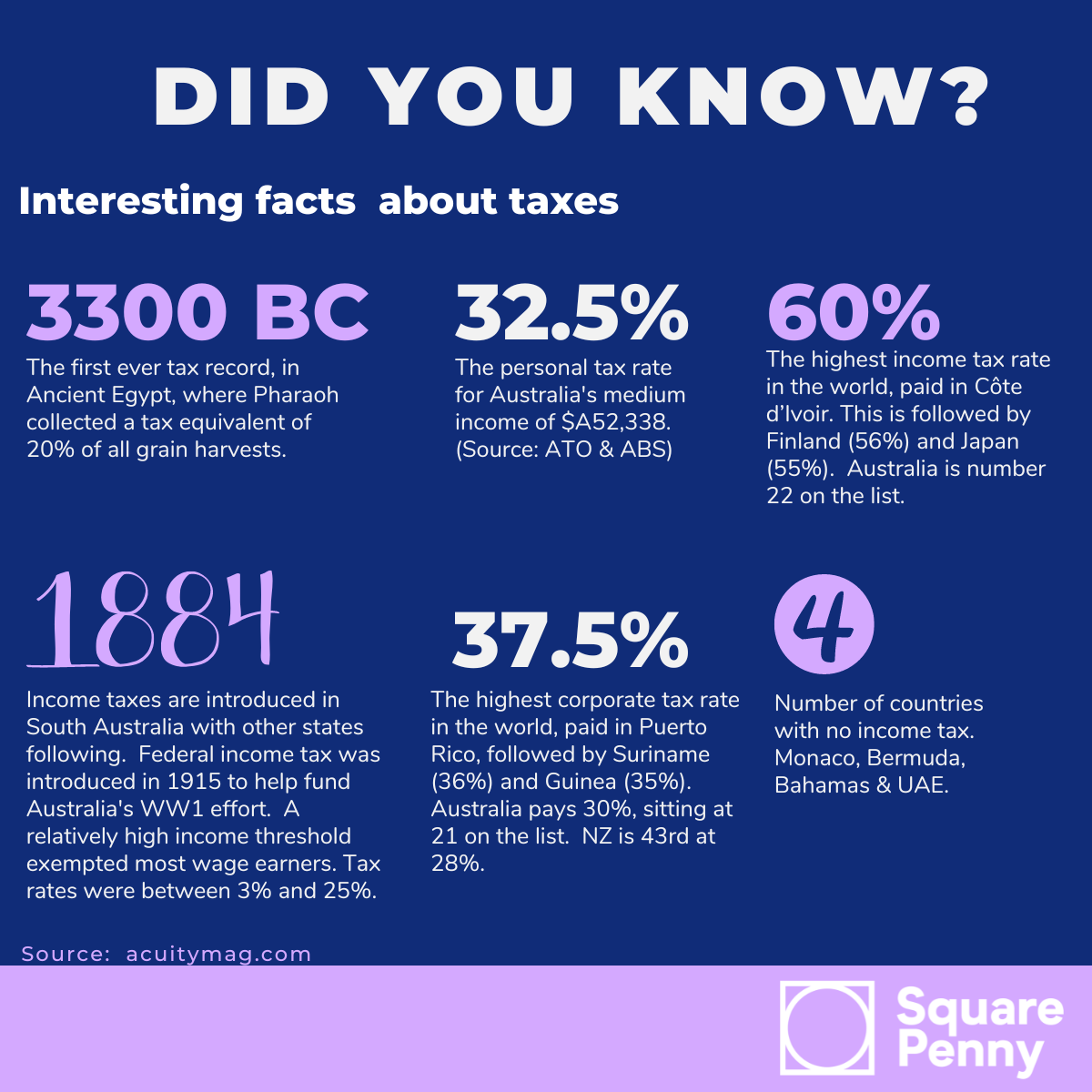

Fun Facts

There are some pretty cool and interesting facts about tax?

Here are 6 surprising tax facts that you may not have known about!

CFO Anne-Maree’s Budgeting Tips

In this short video CFO Anne-Maree, shares her valuable insights and expertise on budgeting and the importance of regular reviews.

A well-prepared budget is crucial because it serves as a road map for your business, allowing you to assess performance, identify gaps, and make informed decisions.

Watch the video and learn how to start working on your budgets effectively.

Need assistance along the way? Our team of experienced

CFOs are always here to support you in achieving your business goals.

Meet Alex Georgiou – Square Penny Business Development Manager

Alex has only been with us a few months but he is already making a big impact at Square Penny. He works closely with SMEs across various industries and business stages and takes the time to understand each client’s unique needs and what makes their business tick.

What Alex loves most about his role is the opportunity to help clients with their financial pain points. He’s passionate in helping businesses overcome their common financial challenges like end-of-month reporting, financial packages, and cash flow forecasting.

Watch the full video to learn more about Alex and how Square Penny can help your business succeed.

Sick Pay, resilience, investigative interviewing and dining vouchers!

March 2022 Newsletter. The Victorian Sick Pay Guarantee and how it can help you Taking time off work when you're sick or taking care of family can...

7 Tips to being more financially in control

February 2022 Newsletter. At Square Penny we are always looking for ways to make our clients lives easier and more efficient, hence why we...

Top 3 business mistakes!

January 2022 Newsletter. Starting and setting up a business can be time consuming and frustrating. You often need to do every task yourself...

Business structures, Super and end-of-year checklists.

December 2021 Newsletter. Choose the Right Business Structure for Your Startup Thinking of starting a business? One of the first administrative...

How to play to your strengths and make this work in business.

November 2021 Newsletter. New mandatory Director Identification Number (DIN/director ID) The Australian Government has announced the introduction of...

Simple, tried and tested, integrated systems and processes.

October 2021 Newsletter. At Square Penny we provide simple, tried and tested, integrated systems and processes to help your business maximise your...

It is our mission to make our client lives easier.

September Newsletter. Business tax deductions during Covid times If you are in an industry that requires physical contact with customers,...

The benefits of losing a client

We lost a really big client recently and naturally my first thought was, oh my gosh what I have done wrong? What have we done wrong as a company?...

Debt Collection

I've been reflecting over the last couple of months on our challenges and certainly the most difficult thing for us has been getting money from our...

Difference in Relationships

What I have learnt about relationships lately.

Struggling to get paid?

Are you struggling to get paid from your clients?

Values

Staying true to your values

Systems and Processes

Damian explains the importance of systems and processes

Confused about where to work?

Are you confused about where to work? I know I am. Do you continue to work from home or go back to the office? Here is what I have learnt how to...

Routine

The importance of following a routine

Decisions

Making hard decisions in business

Business goes in waves

Damian explains the ebbs and flows of business

Exit Strategy

Damian explains why it is important to have an exit strategy for your business

Letting go through efficiency

Damian and Sam discuss the importance of sharing the load Read the full article on blueprinthq.com.au

Motivation

How to stay motivated during these times.